Calculate diminishing value depreciation rate

Here are the steps for the double declining balance method. Find the depreciation rate for a business asset.

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method.

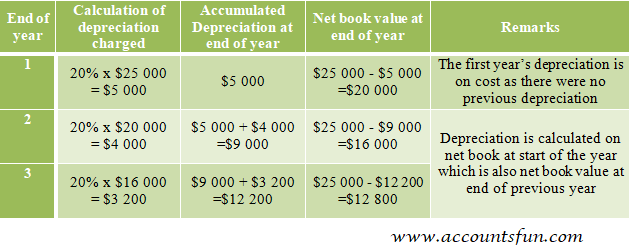

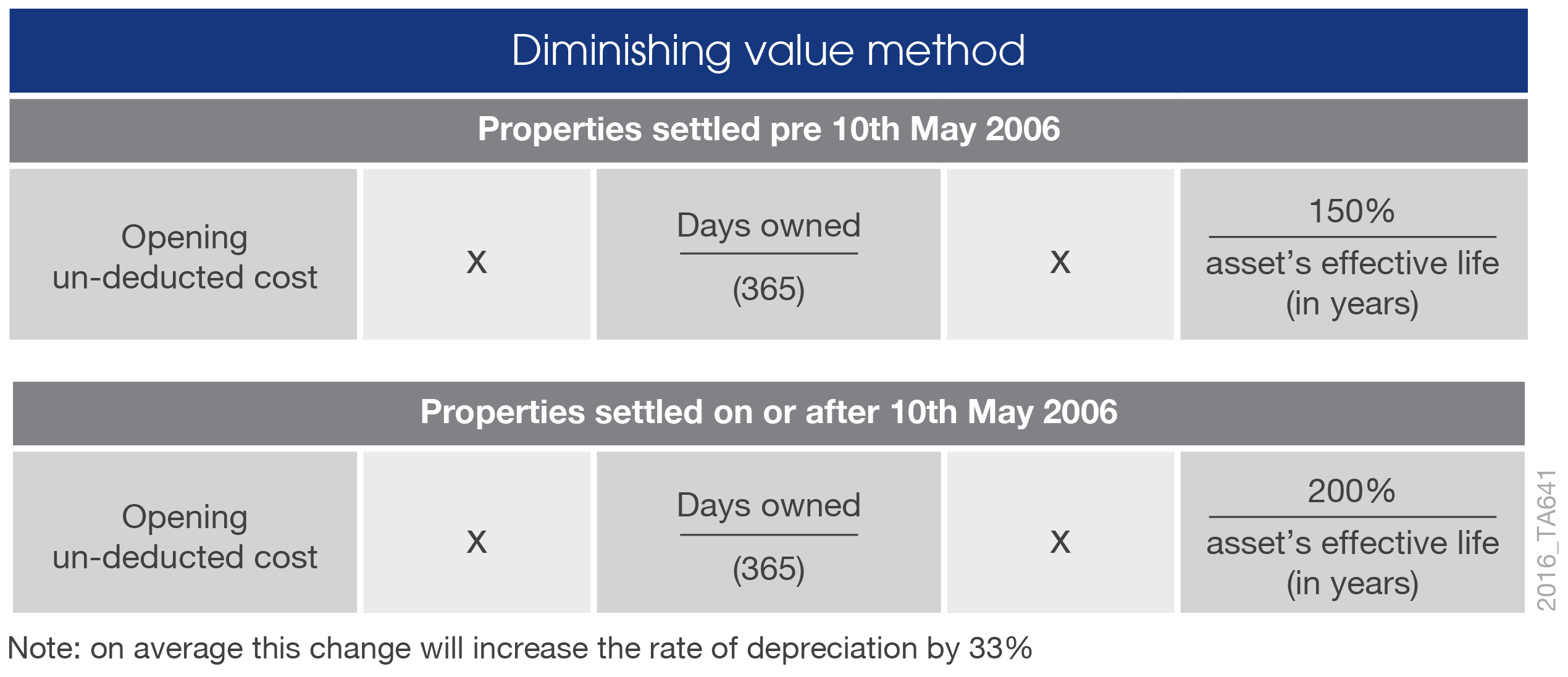

. Find the depreciation rate for a business asset calculate depreciation for a business asset using either the diminishing value DV or straight line SL method view the. Year 1 2000 x 20 400 Year 2 2000 400 1600 x. Base value days held 365 150 assets effective life Reduction for non-taxable use.

For example the diminishing value depreciation rate for an asset. If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is. Depreciation Expense 500 000 24000 60 INR 285600 2.

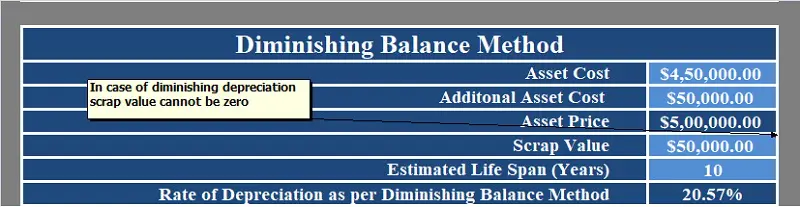

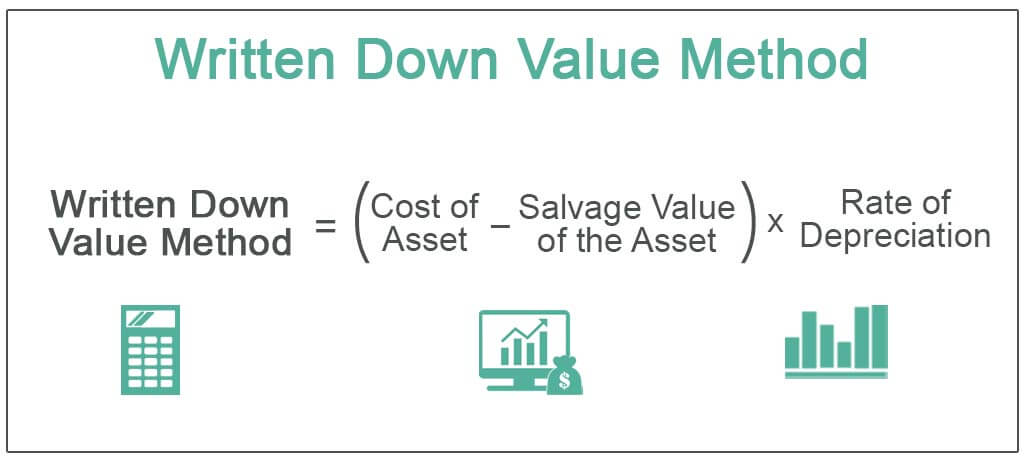

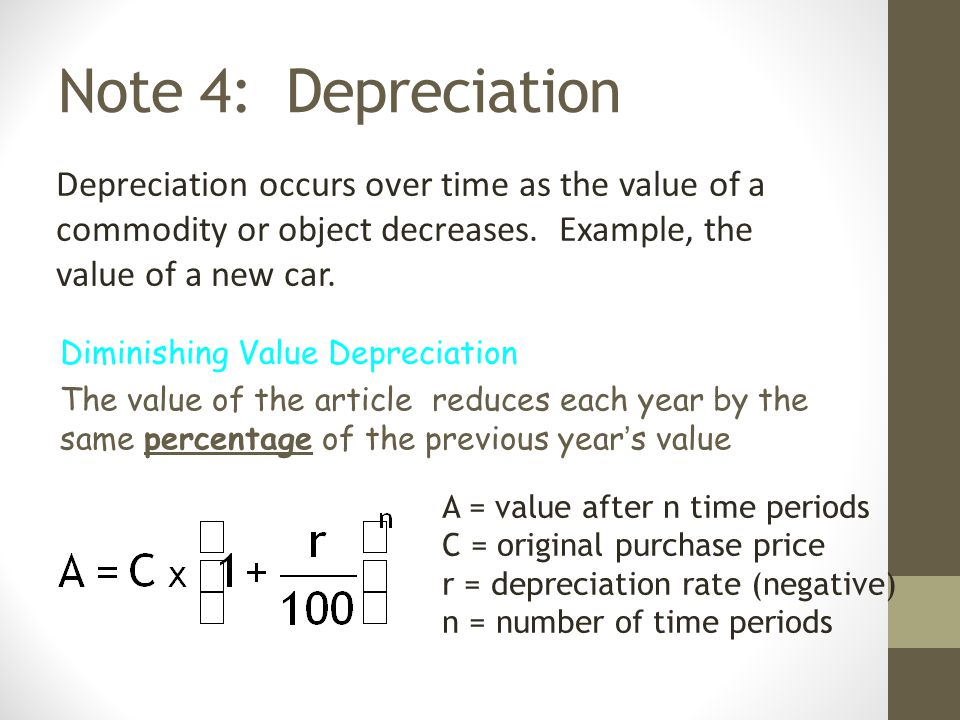

Calculate depreciation for a business asset. The depreciation rate is 20 and the depreciation amount is 16000 in each of the five years. Formula to Calculate Depreciation Value via Diminishing Balance Method.

Subtract Scrap Value from the Asset Cost. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value. Carpet has a 10-year.

2000 - 500 x 30 percent 450. Depreciation per year Book value Depreciation rate Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice. A XYZ limited purchases a truck for 5000.

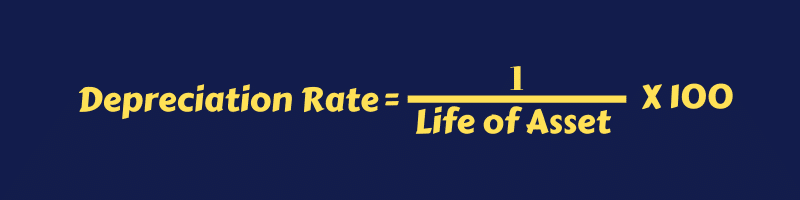

Multiply the book value by the. It is calculated by dividing 200 by an assets useful life in years 150 if the asset was held before 10 May 2006. Follow the below steps to calculate depreciation by Reducing Balance Method.

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. Reducing balance depreciation diminishing value This method of depreciation involves multiplying the asset carrying amount by the depreciation rate to calculate the. Base value days held see note.

This would be applicable for both Straight Line and Diminishing Value depreciation. You can use this tool to. Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full 12 months and is a number M months the first and last years will be.

Depreciation - 10500 calculated from 1306 300606 - But only 4 months. 80000 365 365 200 5 32000 For subsequent years the base. For example the diminishing value depreciation rate for an asset.

In this video we use the diminishing value method to calculate depreciation. Up to 8 cash back Enter an effective life of 8 years the rate is 125 and the annual depreciation is 16250 100 8 125 1300 x 125 16250 Diminishing value. It is calculated by dividing 200 by an assets useful life in years 150 if the asset was held before 10 May 2006.

Find the depreciation rate. Use the diminishing balance depreciation method to calculate depreciation expenses. Depreciation Rate 60 Therefore the solution will be.

Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation youve. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. If the asset costs 80000 and has the effective life of 5 years.

Calculate Diminishing Value Depreciation First Year diminishing value claim calculation.

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Download Depreciation Calculator Excel Template Exceldatapro

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Which Depreciation Method Is Best For You The Real Estate Conversation

Written Down Value Method Of Depreciation Calculation

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Depreciation Diminishing Value Method Youtube

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

Depreciation Formula Calculate Depreciation Expense

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

How To Use The Excel Db Function Exceljet

Depreciation Formula Examples With Excel Template

Note 4 Depreciation Depreciation Occurs Over Time As The Value Of A Commodity Or Object Decreases Example The Value Of A New Car Diminishing Value Ppt Video Online Download

What Is Diminishing Balance Depreciation Definition Formula Accounting Entries Exceldatapro

Depreciation Rate Calculator Discount 57 Off Www Ingeniovirtual Com

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Calculator